In today’s digital finance landscape, various apps compete for our attention and trust. Two popular names often mentioned are Google Pay and Google Wallet. Many users wonder, “do I need both Google Pay and Google Wallet?” Understanding their functions and features can help clarify this question.

What Is Google Pay?

Google Pay: Simplifying Mobile Transactions

Google Pay is a mobile payment platform developed by Google that revolutionizes how users make transactions. It enables users to pay online, in physical stores, or within various apps seamlessly. The app bridges the gap between cash, credit cards, and digital wallets, streamlining the payment process. Users can effortlessly link their bank accounts or credit cards to Google Pay, making it incredibly user-friendly.

Wide Acceptance and User-Friendly Features

One of the key advantages of Google Pay is its wide acceptance across different platforms and stores. This makes it a favorite among many consumers who value convenience. The ease of use, combined with the ability to link multiple financial accounts, adds to its appeal. Whether paying for groceries or booking a flight, Google Pay offers a secure and efficient payment solution. Its widespread adoption and intuitive design position Google Pay as a leading choice for mobile transactions in today’s digital age. By providing a seamless payment experience, Google Pay caters to the needs of a tech-savvy consumer base.

What Is Google Wallet?

Google Wallet: From Storage to Payments

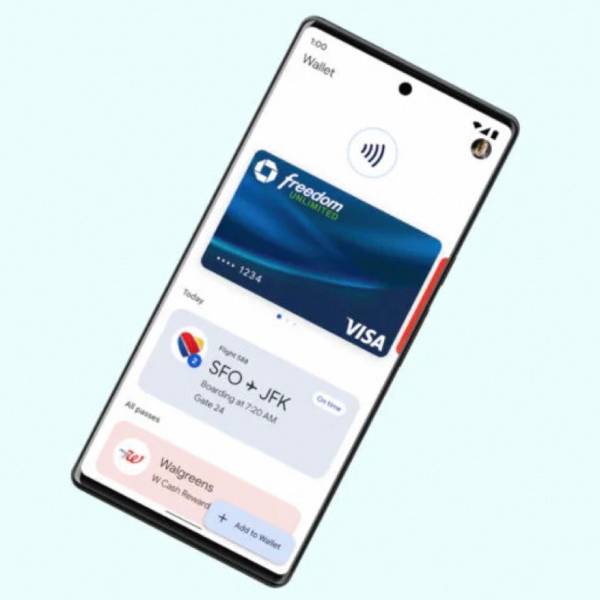

Google Wallet initially served as a digital wallet for storing cards, tickets, and boarding passes. Unlike Google Pay, it focused on organizing digital items. However, Google Wallet has evolved over time and now includes payment features similar to Google Pay. It allows users to send and receive money, making it a versatile tool for financial transactions. This evolution has broadened Google Wallet’s utility, making it more than just a storage solution.

Advanced Features for Financial Management

As Google Wallet has integrated several advanced features for financial management, it has become a comprehensive platform. Users can now not only store their cards and tickets but also manage their finances more effectively. These features enhance the wallet’s functionality, providing users with a single app to handle multiple financial tasks. The integration of payment features with financial management tools positions Google Wallet as a competitive option in the digital payment space. By offering a range of services, Google Wallet caters to users seeking a unified approach to their digital financial needs.

Do I Need Both Google Pay and Google Wallet?

Deciding Between Google Pay and Google Wallet

The decision to use Google Pay or Google Wallet depends on your specific needs. If you prefer managing digital payments within a single app, Google Pay is the way to go. It offers a comprehensive set of features that facilitate secure purchases and easy management of transactions. Google Pay also links with various stores, making it a convenient option for frequent shoppers.

The Utility of Google Wallet

Conversely, if your priority is to keep track of multiple cards and digital assets, Google Wallet is an excellent choice. It places a greater emphasis on organization and storage, providing a centralized location for all your digital items. This focus on asset management makes Google Wallet particularly useful for those who need to juggle various cards, tickets, and passes. By understanding the distinct features of each platform, you can select the one that best aligns with your financial management preferences.

Key Differences Between Google Pay and Google Wallet

Core Differences Between Google Pay and Google Wallet

Understanding the core differences between Google Pay and Google Wallet is essential when deciding whether you need both. Google Pay is designed to streamline payment transactions directly. It aims for quicker checkouts and integrates with multiple merchants, making it ideal for those who frequently make purchases. This platform is all about speed and convenience in the buying process.

Google Wallet: A Digital Asset Repository

In contrast, Google Wallet serves as a digital repository for your cards, tickets, and vouchers. It focuses on organization, allowing users to access various forms of digital assets within the Wallet. This feature is particularly useful for individuals who need a centralized place to manage their digital identities and documents. Google Wallet’s organizational capabilities make it a valuable tool for those who want to keep their digital life tidy and accessible.

Choosing the Right Tool for Your Needs

When deciding whether you need both Google Pay and Google Wallet, consider how you use digital payments and assets. If quick and easy transactions are your priority, Google Pay is likely sufficient. However, if you need a comprehensive system to manage all your digital cards and tickets, Google Wallet is the better choice. By recognizing the distinct functions of each platform, you can select the one that best fits your lifestyle and financial habits.

Therefore, you might want to consider your primary need. If instant payments are what you desire, Google Pay suffices. If organization and storage stand out for you, Google Wallet fits the bill.

Integration and Compatibility

Another important factor is integration. Do I need both Google Pay and Google Wallet to maximize benefits? Not necessarily. While both apps function well independently, they also integrate seamlessly. For example, Google Pay can sync with Google Wallet for easy access to your stored cards. This integration allows for smoother transactions across platforms.

Thus, if you opt for only one app, you still can manage your digital assets effectively. However, having both can enhance your user experience by providing a comprehensive solution.

Security Features of Each App

Both Google Pay and Google Wallet prioritize security. When asking, “do I need both Google Pay and Google Wallet?” consider their security features. Google Pay employs advanced encryption and tokenization. This keeps your payment information secure during transactions. While both Google Pay and Google Wallet ensure a high level of security, when considering Google Wallet receiving money, remember that Google Pay’s advanced encryption and tokenization make it a robust choice for secure transactions.

Google Wallet also offers security measures. Your cards are secured with the app, and only you can access them. The two apps maintain a high level of security, making online transactions safe and private.

In this regard, using one app does not compromise your security.

The Future of Digital Payments

Looking ahead, the landscape of digital payments continues to evolve. The question of “do I need both Google Pay and Google Wallet?” might change over time. Google frequently updates its applications, introducing new features. The integration between Google Pay and Google Wallet may become more seamless in the future. As the digital payments landscape shifts, users may wonder how services like Samsung Pay fit into their evolving payment options, especially with the potential seamless integration of platforms like Google Pay and Google Wallet.

Consumers often demand versatility and flexibility in financial apps. As a result, Google will likely focus increasingly on keeping both apps relevant. Hence, even if you choose one app now, consider revisiting the other later.

Conclusion

Ultimately, the decision to use one or both should align with your lifestyle and financial habits. Do I need both Google Pay and Google Wallet? If you seek efficient transactions, Google Pay is your go-to. If you value organization, Google Wallet will serve you well. Consider integrating a Google Wallet shortcut for easy access to all your organized financial information, allowing you to streamline your transactions and keep everything in one place.

In summary, the features offer different advantages. Consumer needs will dictate their usage. By comprehensively understanding both apps, you ensure that your financial tasks remain manageable. Therefore, make an informed choice based on your specific needs. The digital payment world will continue to grow, allowing you to adapt as necessary.